Why "hypothetical" results and performance?

All performance reports on C2 must be regarded as hypothetical. This is because, among other reasons, no single real-life brokerage account looks exactly like the trade record you see on C2 (for example, no single account has AutoTraded all signals since the system started; and some systems, particularly those that are new, have no live AutoTraders at all, but rather rely on simulated executions).

Also, it's good to remember that C2 gives AutoTraders lots of power to "personalize" and exert control over AutoTrading even when they do trade using a live brokerage account. So, C2 AutoTrade can be used in a completely hands-free manner if you want (turn it on and let it trade) or, alternately, you can exert a lot of control on a trade-by-trade basis (for example, setting your own stop-losses, taking profits early, closing losing trades early, making trades bigger or smaller on the fly, etc.)

So this means that some transactions (manual adjustments by subscribers outside the trading system, personally-customized stop losses, synchronization trades, etc.) are not displayed in the common C2 Model Account trading record that you see, because they are specific to each individual AutoTrader account. This is yet another reason why, even if a system has live AutoTraders, our results must still be regarded as "hypothetical" - the results you see posted do not match any specific real-life account. Results are marked to market.

Does this mean you can't trust C2 results?

Of course you can! Here are a few reasons why:

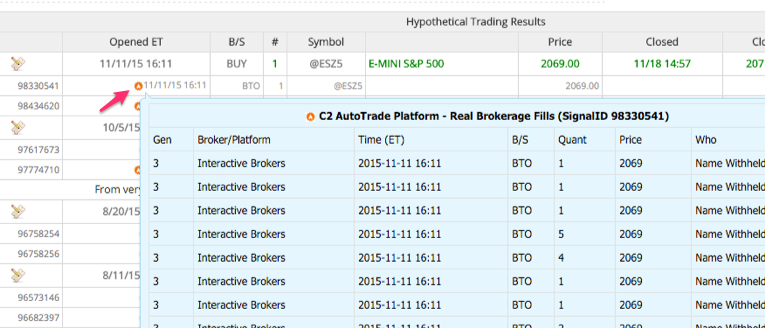

- If a system is AutoTraded by anyone, the execution fill prices shown on C2 are the VWAP (volume-weighed average price) of all real-life AutoTraded fill prices.

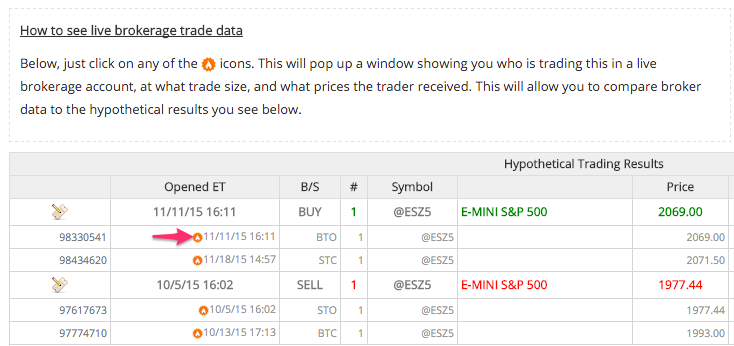

- Actual real-life AutoTraded fill prices are displayed on the System Details page. This allows your to compare the fills obtained by traders in their real accounts vs. the C2 Model Account results.

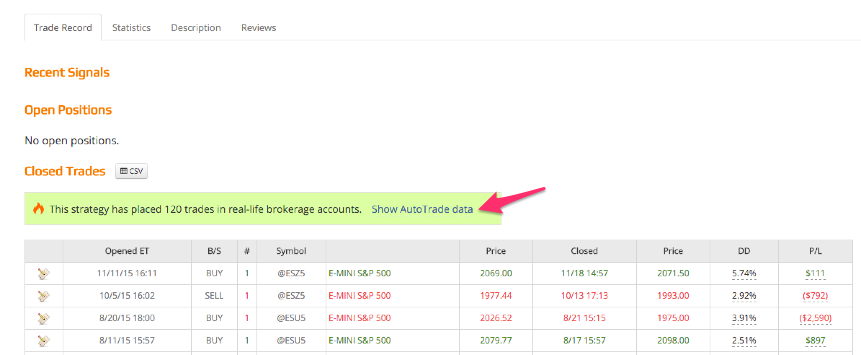

To see real-life fills, click the "Show AutoTrade Data" link:

Now, trades that have real-life AutoTrading data will appear with a red monitor icon:

Click the icon to see how real-life traders did, compared with the C2 Model Account:

- C2 does not modify trading records. When a system issues a "Buy" or "Sell" signal, we post our best estimate of what real-life traders would see in their accounts. When we have real-life data from real accounts, we use that as the basis for posted trade results. When we don't, we use real-time data feeds to estimate results.

- System publishers cannot delete signals or selectively edit or modify them with the benefit of hindsight. So, for example, if they issue a signal to "BUY" and then suddenly see a losing trade, they can't remove the trade from their record and say something like, "Er, but I reallly would not have actually issued that trade." Whatever executed signal they issue becomes part of their permanent trade record.

- System publishers cannot post historical (i.e. back-tested) results. All results on C2 are based on go-forward real-time orders.

C2 does not delete or hide failed trading systems.

Now, of course the warning still applies to all the results you see on Collective2.eu:

All performance claims on this web site about trading system performance must be regarded as hypothetical. Use of this Web site to offer or subscribe to a trading system indicates you agree to our Terms of Service. There is often a vast difference between hypothetical results and real-life trading results achievable in an a real brokerage account, and real-life results are almost always vastly worse than hypothetical results.

These results are based on simulated or hypothetical performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program, which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Related Articles

Can I show backtested results?

Because of our peculiar philosophy about the importance of "go-forward public commitment," we eschew backtested results due to the selection bias inherent in them. Thus we do not allow you to import backtested results into your C2 system. However, ...A system is missing from my Performance Report. Where is it?

From the Performance Report If you click on the to the right of your P/L amount, it will "hide" the system from view. To make systems visible again, click on the blue text above the list of systems that says "Restore hidden systems".How can I see unrealized loss if I am not a subscriber? Do you include it in the Hypothetical Monthly Returns?

The main point here is that all the 'unrealized losses' you see are already included in the strategy page (even if you are not subscribed to it). This means that unrealized losses were included in all the results that were reported, including: The ...When will my hypothetical monthly returns table show up?

When your strategy is more than thirty days old.What does a dash (-) mean on hypothetical monthly returns?

A dash (-) on monthly returns means that the net equity value of the system changed so little that the change rounded to zero.