What if I AutoTrade two strategies in my brokerage account?

What if I AutoTrade two strategies in one brokerage account? What if the strategies go long and short the same symbol simultaneously? Won’t it affect my results?

No. At C2, you use one brokerage account to trade multiple strategies… even if those strategies go long and short at the same time. Positions from multiple strategies are added together (the technical term is “offset”).

In a moment, you will discover that one achieves the same exact profit/loss results during every moment of the trade regardless of whether he/she trades two strategies in two different accounts, or if he/she trades two strategies in one combined account.

Let’s look at an example.

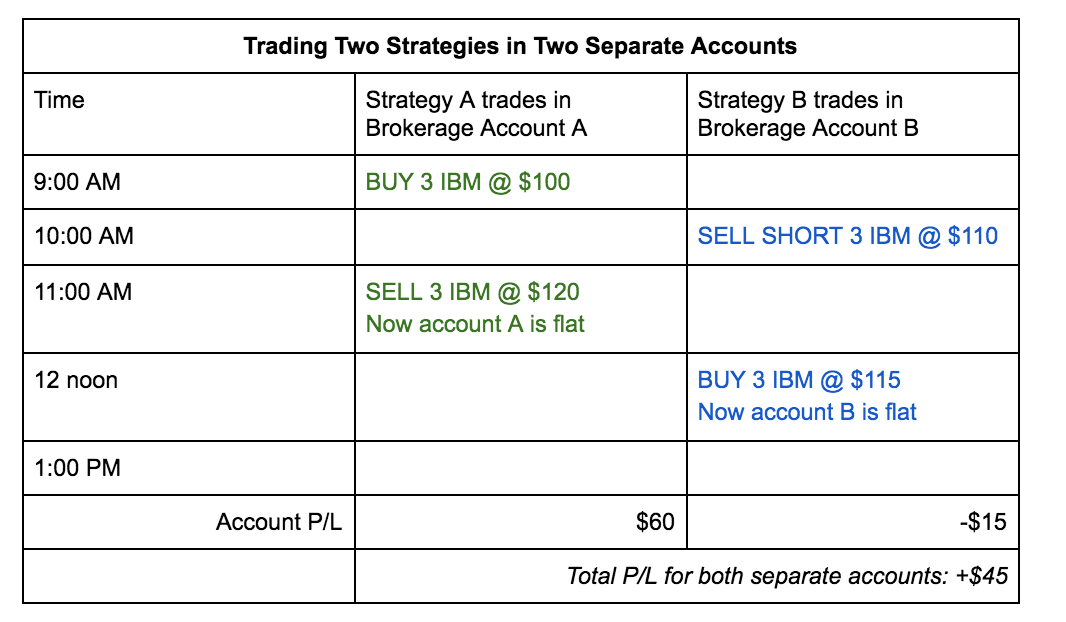

First, imagine you trade two strategies in two separate accounts:

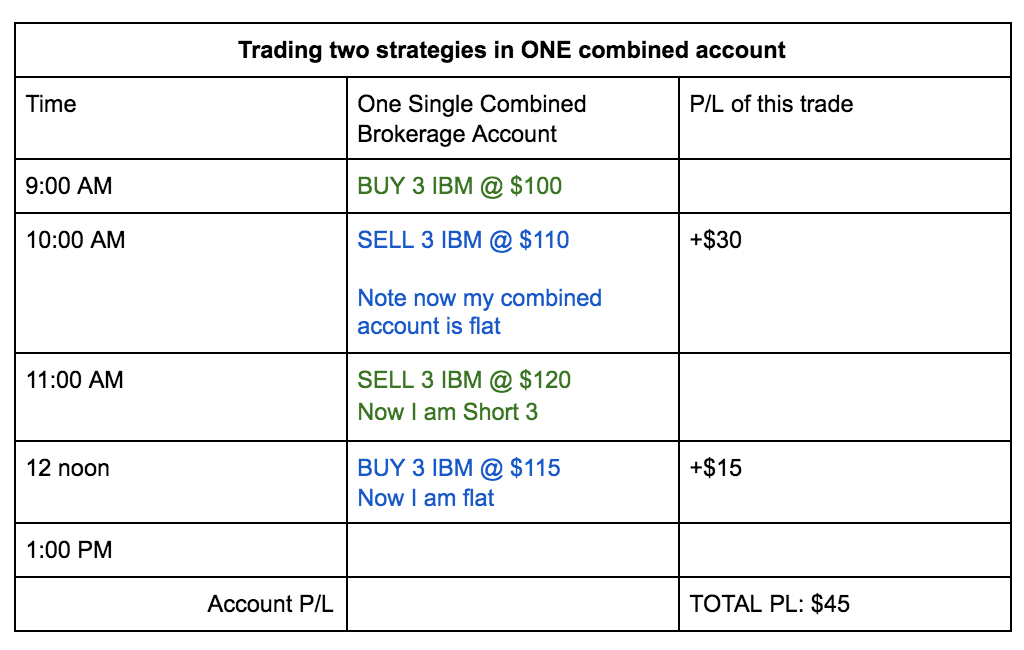

OK. Now, what if we use C2 technology to trade the same exact two strategies (and the same exact trades)... in ONE brokerage account? Will the results be different?

(Answer: NO. They will be exactly the same.)

Watch:

Notice how both tables show the exact same sequence of trades, placed at exactly the same time. The second table shows the trades being placed in one single account. Yet everything winds up exactly the same! (This will be true whether we are talking about two strategies or two hundred strategies or two million strategies!)

But wait! Perhaps you look at the table above, and you wonder about what happened at 10:30 AM. You say, “Hold on. At 10:30 AM I was FLAT in my combined account. But in the very first table (the table showing two strategies in two accounts) you see that Strategy A was “long 3” at 10:30 AM. Is that a discrepancy?

No. Look carefully at the very first table (“Trading Two Strategies in Two Separate Accounts”), up above. At 10:30 AM, strategy A was “Long 3." But at 10:30 AM, Strategy B was “Short 3.” Since I am one human being, and I own both trading accounts, I was both “long 3” and “short 3” at the same time.

What does it mean when one human being is long 3 and short 3 at the same time? It means he is “flat.”

So, again, the two scenarios are exactly identical. They are identical in terms of profit-and-loss. They are identical in terms of which positions are held at the same moments in time.

What about regulations which prohibit being long and short at the same time? Doesn’t this violate those rules?

No. Look carefully at the second table, just above (“Trading two strategies in ONE combined account”). Do you ever see a circumstance where the account itself holds two positions at the same time: one long and one short?

No, you do not. Because that never happens.

Yes, there are cases where a single “strategy” is long at the same time that another “strategy” is short. But the exchanges don’t give two hoots about your strategies.

It’s analogous to having multiple personalities. The exchanges don’t give two hoots if you have multiple personalities, and one of your personalities is long, while the other is short. What they care about is whether you actually have a long position inside your account at the same time that you have a short position inside your account.

But at C2, that never happens.

At C2, when one strategy goes long, and one strategy goes short, here is what the exchange and the broker both see: you are flat.

When an account is flat… it is the same as being long and short at the same time.

C2 software never communicates to the exchange: “Please make the customer have a long position. At the same time, please make the customer have a short position.” That’s definitely not allowed. But that’s not what we do!

Instead, what we say to the exchange is: “Please make sure the customer has NO position.” That is very certainly allowed.

Summary

Customers sometimes mistakenly believe that they cannot trade multiple strategies in one account, because they fear that results will be affected in cases where one strategy takes a long position in a symbol while another strategy takes a short position.

This is not true. You can trade one… two… two thousand… strategies in one single account. C2 simply “offsets” the positions so that the broker (and the exchange) see one single position, even if that “single” position is the result of multiple strategies’ intentions.

At the end of the day, the profit and loss results are identical no matter how many accounts you use.

Related Articles

Can I AutoTrade multiple strategies trading the same instrument in the same brokerage account?

Yes you can! C2 handles this scenario seamlessly and it will Autotrade each strategy separately so that each system can be tracked from the Open Positions page on C2. Let's take an example of two strategies trading the same instrument. Strategy 1 ...What happens if a manual order is placed in my brokerage account that is AutoTrading?

Such orders are called "external" since C2 did not send them. If you place a manual order in your account from the broker's software, web site or over the phone, AutoSync will be disabled and an automated email will be sent to you to inform you of ...What happens if I receive a margin call on my brokerage account?

While it is not always possible for us to detect margin calls due to broker technology limitations, whenever we do, we will disable AutoTrading on your brokerage account to prevent any further orders until you re-enable AutoTrading. Please note that ...AutoTrade your own strategy - Instructions to earn badge

Earn the Trades-Own-Strategy (TOS) Badge Collective2 makes a special effort to promote trading strategies which are AutoTraded by the Trade Leader. We call this the TOS Program. We want you to join. Benefits of participating Strong ...What is Two-Factor Authentication for my broker account?

Two-factor authentiation is an additional layer of security for your IBKR account designed to confirm that you and only you, can access your account, even if someone else knows your password.